Copper Bounces Off Lows Following Record Crash

Copper Bounces Off Lows

Copper prices are fighting to stabilise today following a seismic move lower over the last week. Copper futures reversed sharply from YTD highs, plunging by more than 20% amidst the fallout from Trump’s tariff announcement last week. The futures market has now found support into a retest of the current YTD lows, with price subsequently bouncing around 7% higher.

Bearish Risks

Sentiment remains weak, however, and with the threat of a further escalation in the trade war, the risks of a fresh downside in copper remain strong. Chinese retaliation against the US, along with warnings that further action will be taken, mean the trade stand off could get worse before it gets better. Against this backdrop, any rebound in copper is likely to struggle to sustain itself.

Chinese Demand Lifting

On a brighter note, market chatter is pointing to wards better demand from China into these lows. ANZ Research this week noted that the sell off has found demand from Chinese fabricators which had previously struggled to attain supply with copper being rerouted to the US to attain premium prices ahead of the tariffs taking effect. Expectations of further fiscal support from the Chinese government is also helping stoke demand at current levels. However, any further negative trade headlines can easily see copper prices break lower again and, as such, near-term volatility risks remains high.

Technical Views

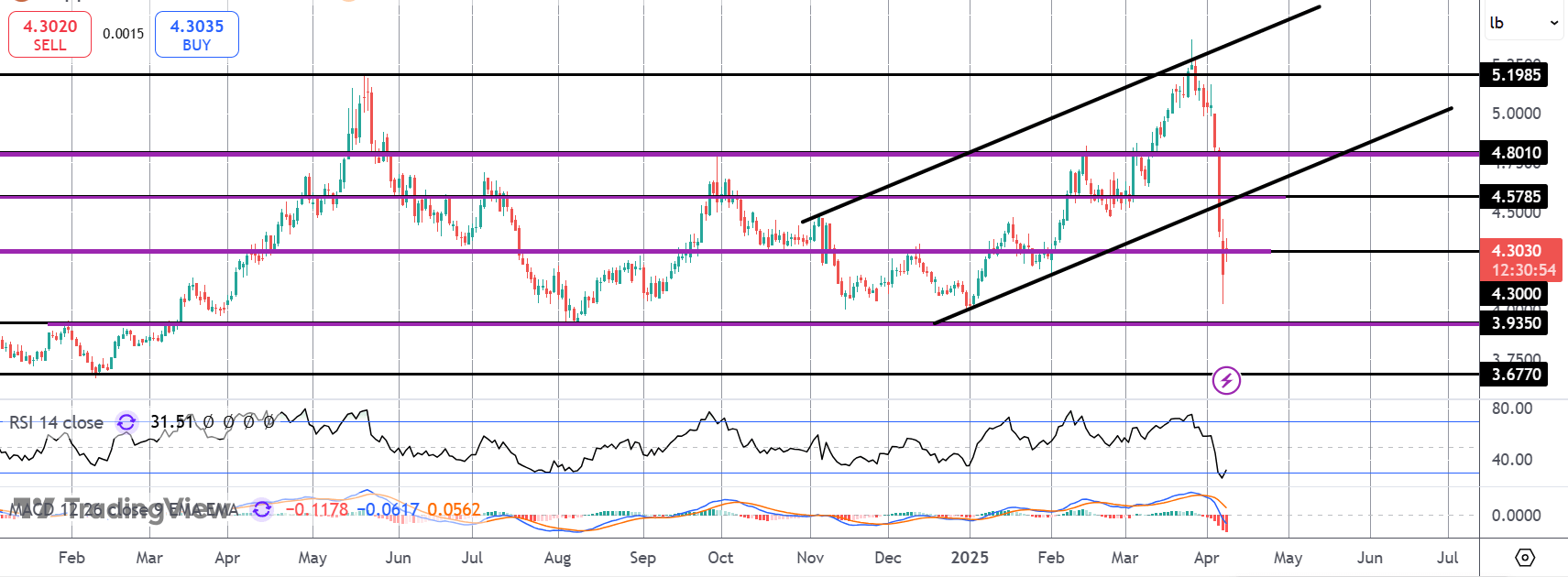

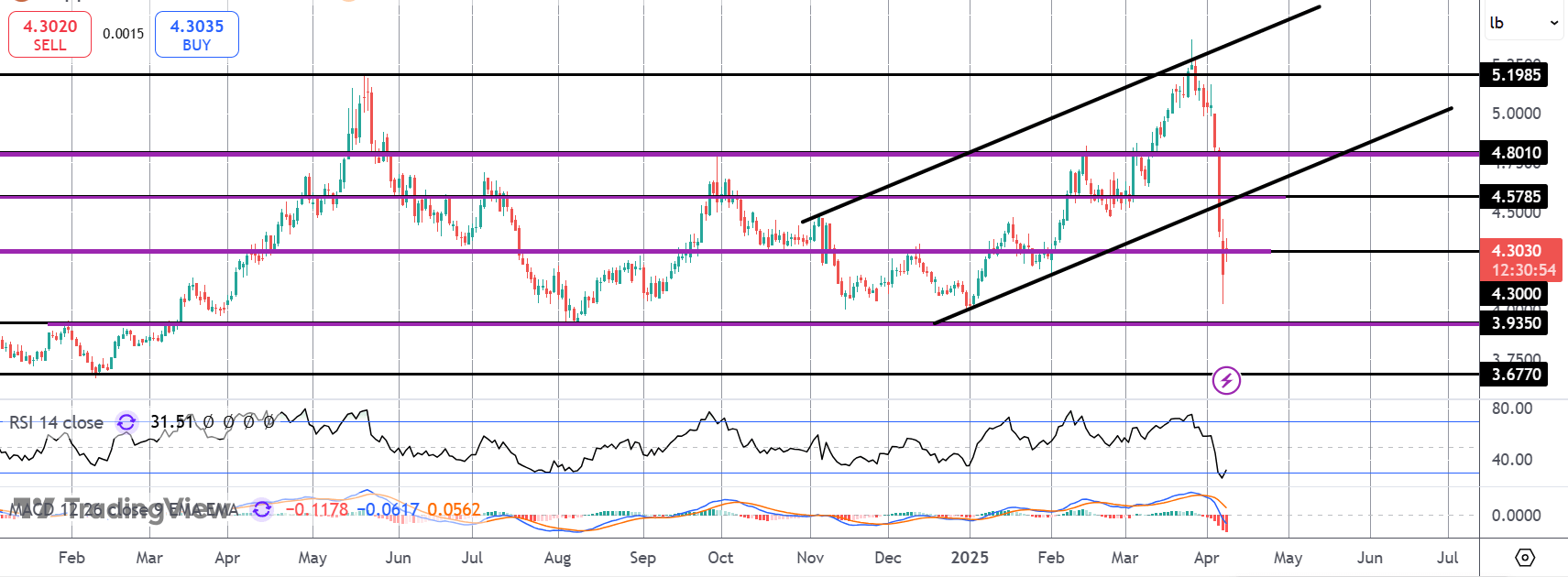

Copper

The sell off in copper has seen the market breaking down through several key levels, as well as the bull channel lows. Price has since stalled into a retest of the 2025 lows and is now fighting to get back above the 4.30 level. Above here, 4.5785 and a retest of the bull channel lows will be the next hurdle. To the downside, 3.9350 is the key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.