The Crude Oil Chronicles - Episode 1

Welcome to our first installment of the Crude Oil Chronicles - a weekly comprehensive look into global oil inventories and prices!

US Crude Stores Fall Again

While focus over the last few months has been on concerns regarding the demand outlook for oil, recent industry reports have started to paint a different picture. The latest report from the Energy Information Administration, covering the week ending July 26th, showed that US crude stockpiles were once again in drawdown. Inventories fell by a further 8.5 million barrels over the week, far outstripping expectations of a 2.6 million barrel decrease. The report showed that inventories at the Cushing delivery hub in Oklahoma were down 1.5million barrels alone. This latest decline marks the seventh consecutive week which the market has been in drawdown.

Gasoline Inventories Down Also

Elsewhere, the report also showed a decrease in refinery crude runs, which moved lower by 43k barrels a day, with refinery utilisation rates dropping by 0.1%. Gasoline inventories were also down by 1.8 million barrels over the week, which was more than the forecasted 1.4 million barrel decline the market was looking for. Distillate stockpiles, which include diesel and heating oil, were also down by 894k barrels over the week, however this was slightly less than the 1million barrel drawdown the market was looking for.

Libya Supply Disruptions Noted

Away from inventory declines in the US, crude prices have also been supported this week due to supply disruptions in Libya. It was reported that the Sharara oil field, which is Libya’s largest, was closed on Tuesday due to an issue with a valve which connects the pipeline to the Zawiya oil terminal.

Middle East Tensions Supportive

Geopolitical elements are also keeping oil prices well bid. Tensions in the Middle East have ratcheted higher this week with the US formally asking Germany to join both France and the UK in helping it secure the Strait of Hormuz. This comes in the wake of the seizure of a British tanker by Iran and threats of further such action. With ongoing tensions in the area and the risk of military action, particularly between the US and Iran, prices remain elevated.

US / China Trade Talks Boost Oil

The market is also keeping a close eye on the US / China trade negotiations which got underway again this week. The oil market was boosted strongly over the first part of the year, by positive developments in trade negotiations between the two leading global economies. However, as talks fell apart in May and fresh tariffs were announced, oil prices reflected the disappointment among traders. The market is now hopeful that both sides will be able to work together to secure a deal which will keep economic activity in China on track, keeping oil supported.

USD Rallies on FOMC

The FOMC meeting last night put a slight dampener on the week’s movements in oil however, the market reacted with disappointment to the Fed’s well signalled .25% cut, seeing the USD surging higher. Forward guidance was also not as dovish as many were anticipating, with Fed chairman Powell noting that he did not foresee this being the start of a lengthy easing cycle but merely a “mid-cycle adjustment”.

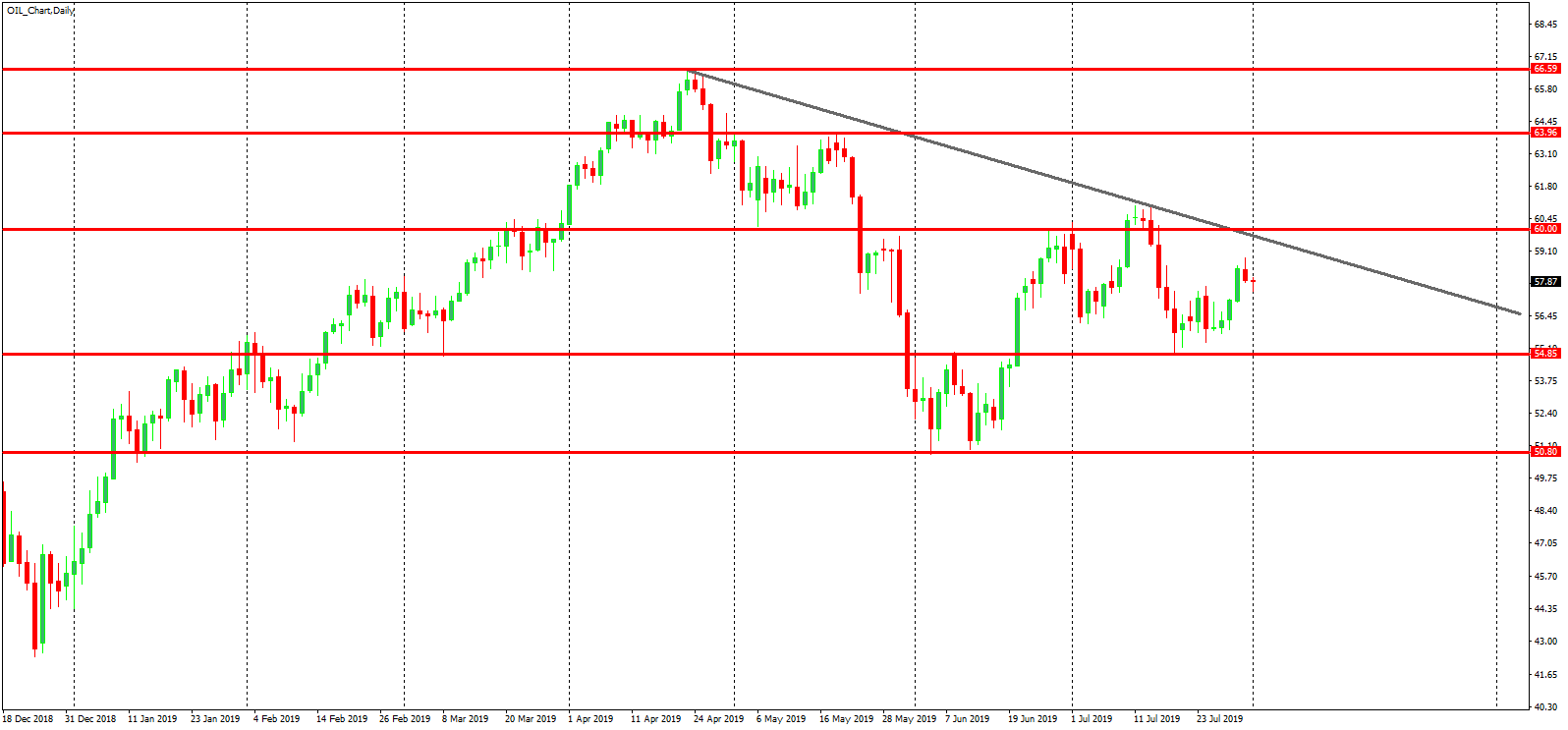

Technical Perspective

For now, crude remains capped by the bearish trend line from year to date highs, sitting just above market and slightly ahead of the 60 structural level. If price can break above here, focus will shift back to a test of the 63.96 level next, ahead of the 2019 highs around 66.59. If we fail to break the 60 level, however, a rotation lower back towards the 54.85 level might be in store.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.