Daily Market Outlook, May 3, 2024

Munnelly’s Macro Minute…

“Huge Apple Buyback Boosts Markets Ahead Of Pivotal US Payrolls”

On Friday, Asian stocks reached their highest level in 15 months, driven by the tech sector and Hong Kong stocks. Meanwhile, the yen strengthened, moving further away from its recent 34-year lows, following a week of suspected intervention by Japanese authorities. With Japan and mainland China markets closed, trading activity in the region is expected to be quiet as traders anticipate the release of U.S. nonfarm payrolls data later in the day. The oil price increased modestly overnight, but it has sharply decreased for the week, with the Brent crude price currently trading close to its lowest level since early March at around $84bbl. During after-market hours, Apple announced its quarterly results and forecast, surpassing modest expectations and also introducing a record share buyback program. As a result, its stock surged by almost 7% in extended trading.

The main focus this week has been on the US as markets anticipate signals for when the Federal Reserve will cut interest rates. Today, there is a busy US data calendar, with the labor market report being a key signal of economic conditions. Employment growth has mostly surprised on the upside so far this year, with the last report for March showing a rise of 303k, the largest monthly gain in over a year. There are some signs of market weakening, including declines in job vacancies and a slowing in turnover, but this has not yet affected unemployment claims or other job surveys. The expectation is for another strong monthly rise in April of 255k, close to the recent monthly average, as well as a small fall in the unemployment rate to 3.7%, slightly below consensus estimates. Interest also lies in the wage growth mentioned in the report, especially after an alternative measure of labor costs released earlier this week showed faster than expected growth in Q1. The expectation is for an April monthly wage rise of 0.3%, the same as in March. The April ISM services reading will provide further insight into US economic conditions, with the service sector continuing to look stronger despite a downside surprise in its manufacturing equivalent earlier this week.

Overnight Newswire Updates of Note

Traders Pull Forward First Fed Cut To November Ahead Of Jobs

US Shuffles Military Assets In Middle East After Gulf Pushback

ECB Is Not Pre-Committing To Particular Rate Path, Lane Says

Three Rate Cuts More Likely In 2024, Stournaras Tells Liberal

Labour Win Brexit Strongholds In Early Local Election Result

UK Store Footfall Falls As Wet Weather, Earlier Easter Weighs

Poll: RBA Set To Hold Rates In May, Only Cut Once By End-Year

Market Hunts For Japan Yen Intervention Signs In Fed Accounts

Oil Sees Biggest Weekly Drop Since February As War Risk Fades

Gold Set For Worst Weekly Run Since February On Rate Outlook

Apple Rallies On Upbeat Forecast, Record-Setting Stock Buyback

Glencore Studying An Approach For Anglo American, Sources Say

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0600 (899M), 1.0650 (618M), 1.0675-85 (1.8BLN)

1.0695-05 (2.07BLN), 1.0725-35 (1.31BLN), 1.0750-60 (1.3BLN)

1.0775-85 (822M), 1.0795-00 (1.35BLN), 1.0810-15 (1.0BLN)

USD/CHF: 0.9050 (201M), 0.9100 (402M), 0.9125 (220M)

GBP/USD: 1.2500 (450M), 1.2510-15 (348M), 1.2550 (205M)

1.2600 (302M). NZD/USD: 0.5950 (942M)

AUD/USD: 0.6450 (1.4BLN), 0.6475-80 (545M)

0.6490-00 (2.41BLN), 0.6510 (400M), 0.6520-25 (876M)

0.6535-40 (635M), 0.6550 (274M), 0.6600 (1.6BLN)

USD/CAD: 1.3515-25 (801M), 1.3600-10 (375M), 1.3635-40 (330M)

1.3650-55 (645M), 1.3700-10 (704M), 1.3850-55 ( 1.3BLN)

CFTC Data As Of 26/04/24

Japanese yen net short position is -179,919 contracts

Euro net short position is -9,989 contracts

Swiss Franc posts net short position of -42,562 contracts

British Pound net short position is -26,233 contracts

Bitcoin net position is 0 contracts

Equity fund managers cut S&P 500 CME net long position by 16,969 contracts to 833,074

Equity fund speculators trim S&P 500 CME net short position by 9,927 contracts to 183,864

Gold NC Net Positions: $201.9K vs previous $202.4K

Technical & Trade Views

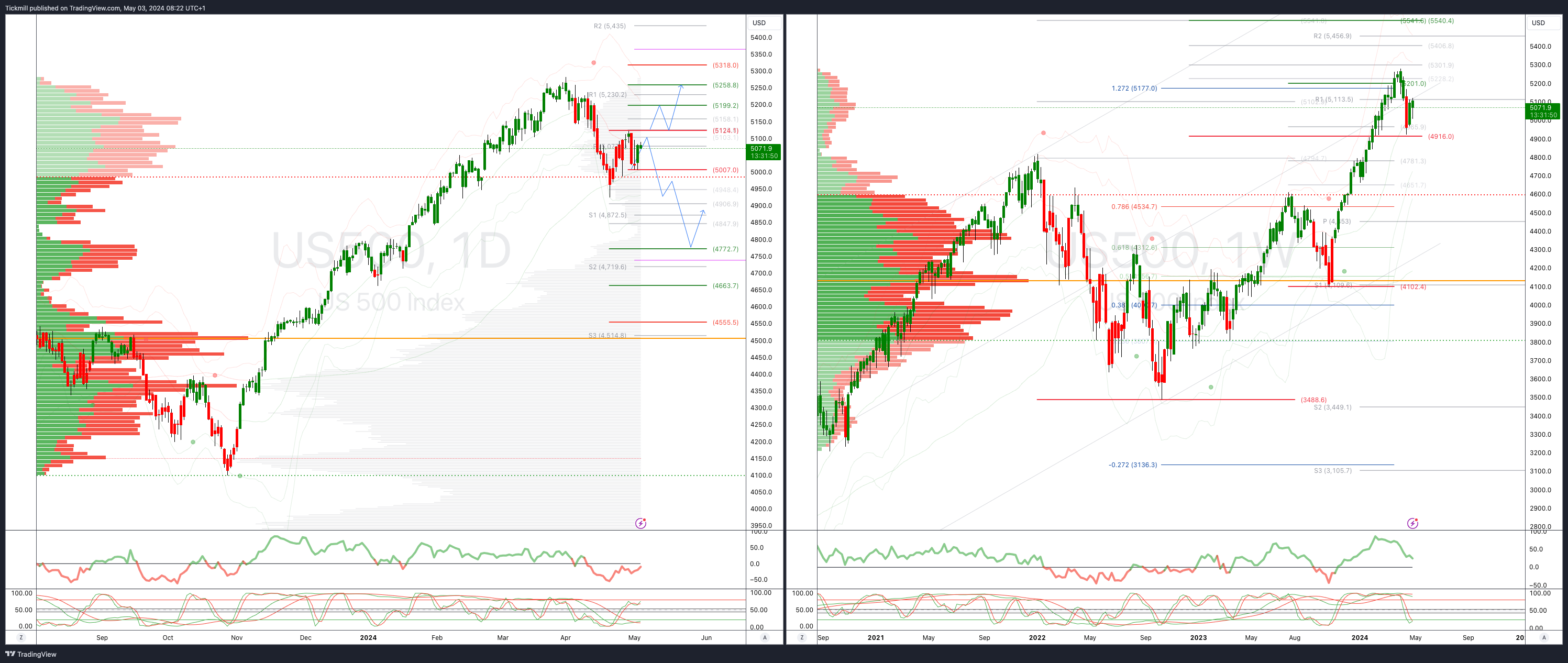

SP500 Bullish Above Bearish Below 5060

Daily VWAP bullish

Weekly VWAP bullish

Below 4987 opens 4920

Primary support 4987

Primary objective is 5150

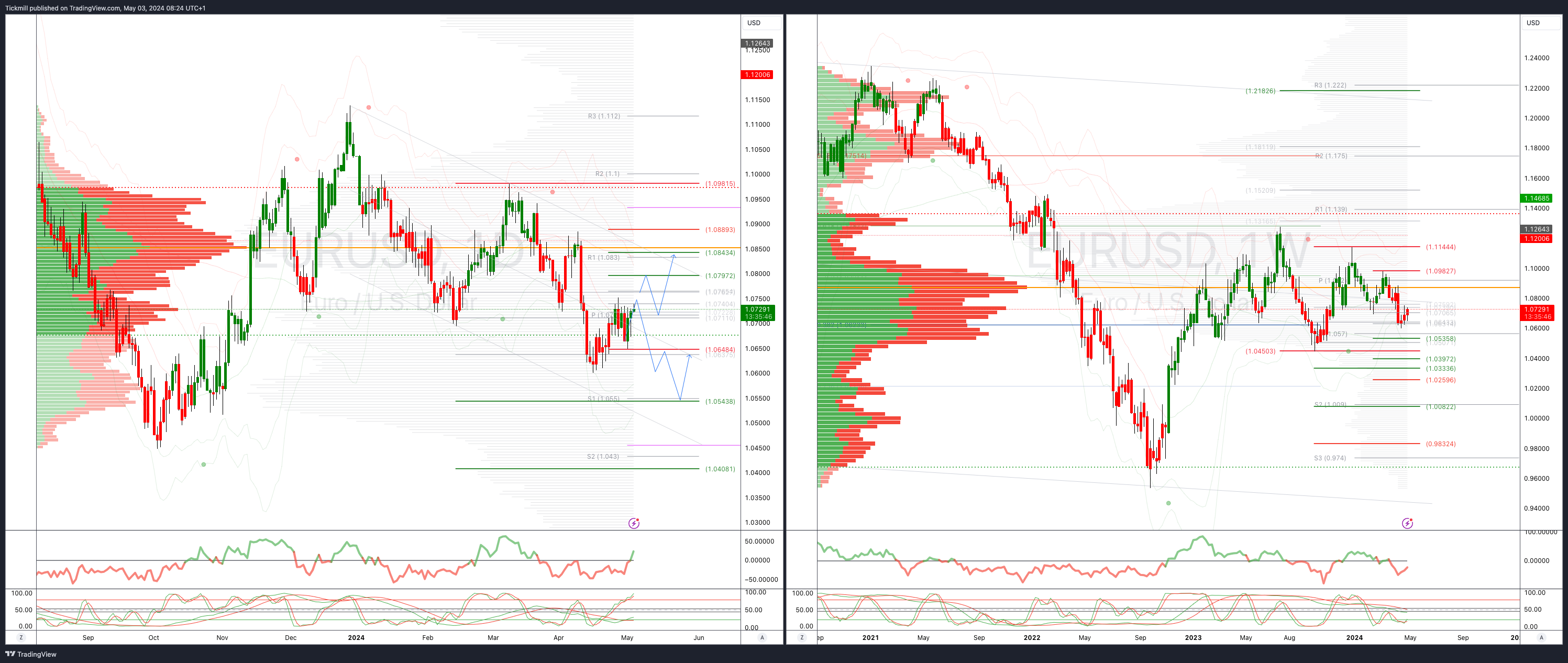

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bullish

Weekly VWAP bearish

Above 1.0730 opens 1.088

Primary resistance 1.850

Primary objective is 1.0550

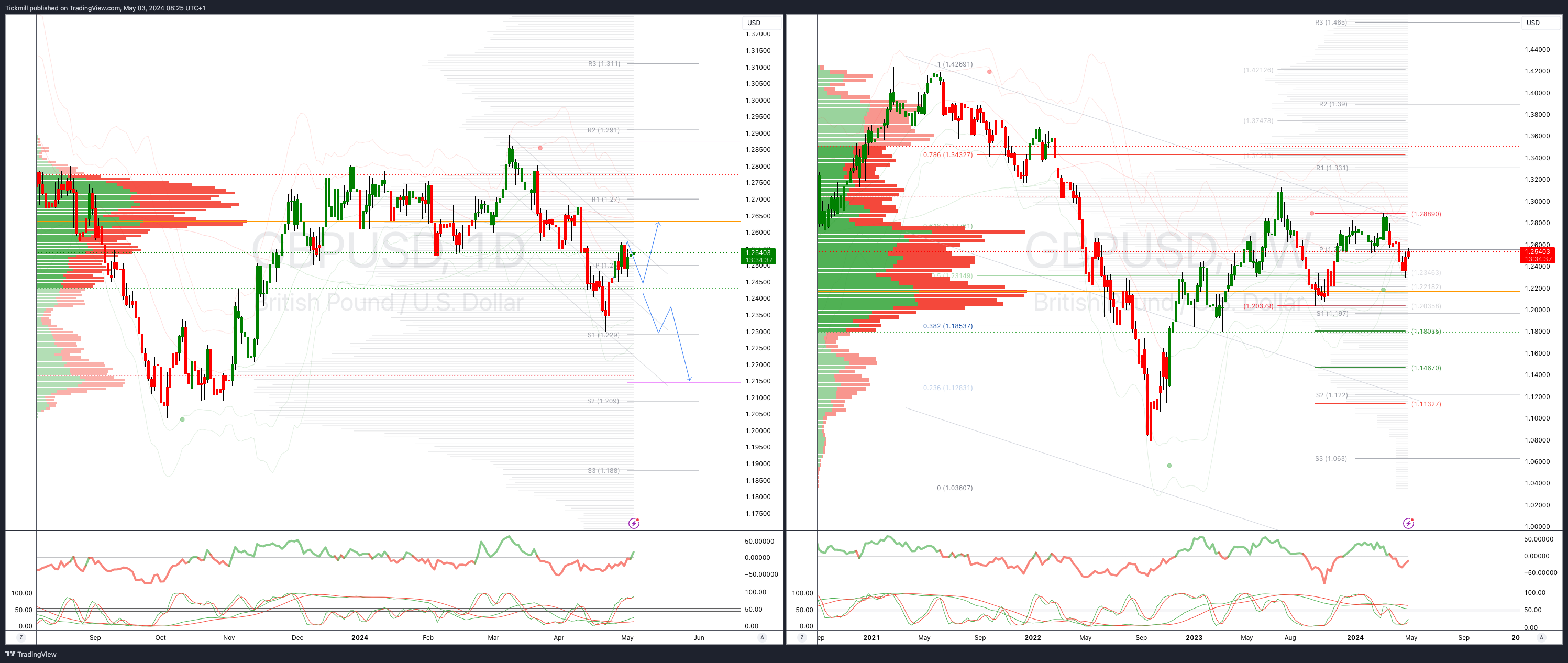

GBPUSD Bullish Above Bearish Below 1.2450

Daily VWAP bullish

Weekly VWAP bearish

Above 1.2590 opens 1.2640

Primary resistance is 1.2710

Primary objective 1.26

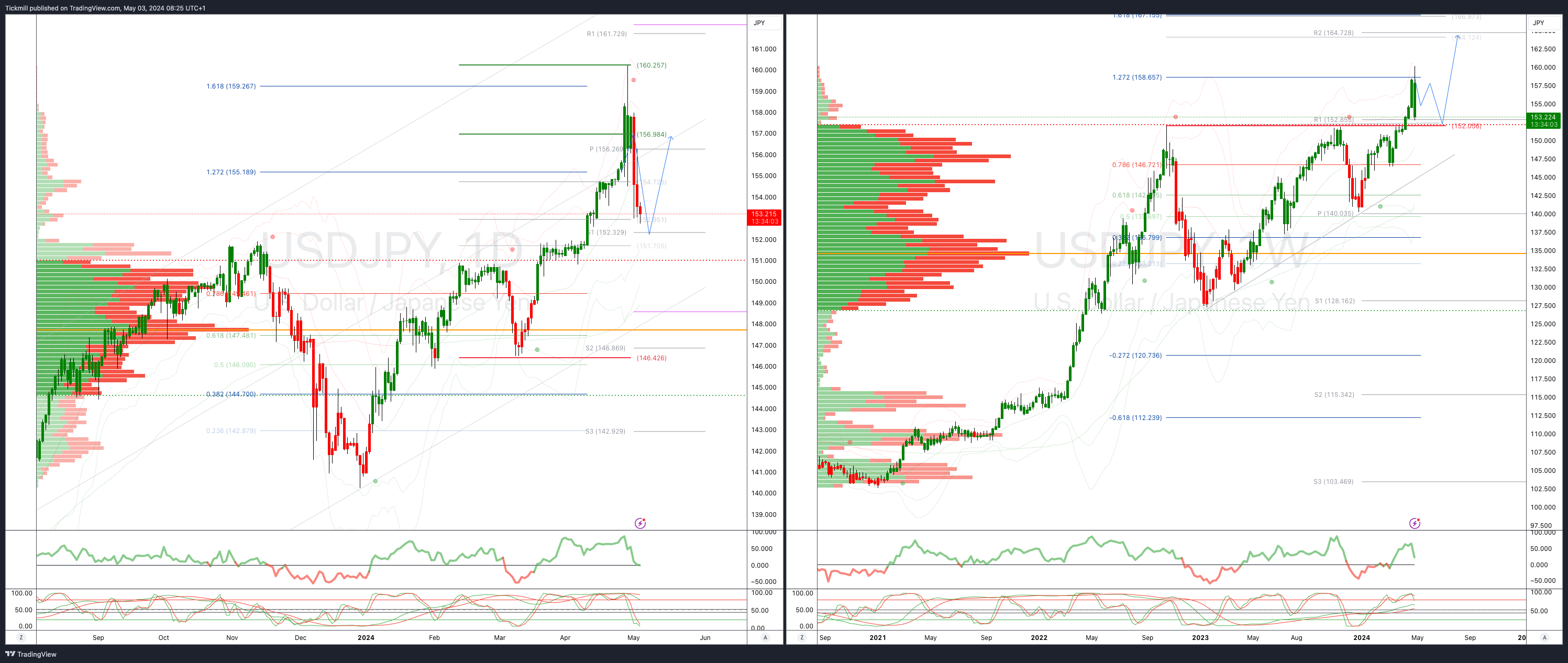

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bullish

Below 154.40 opens 152

Primary support 152

Primary objective is 165

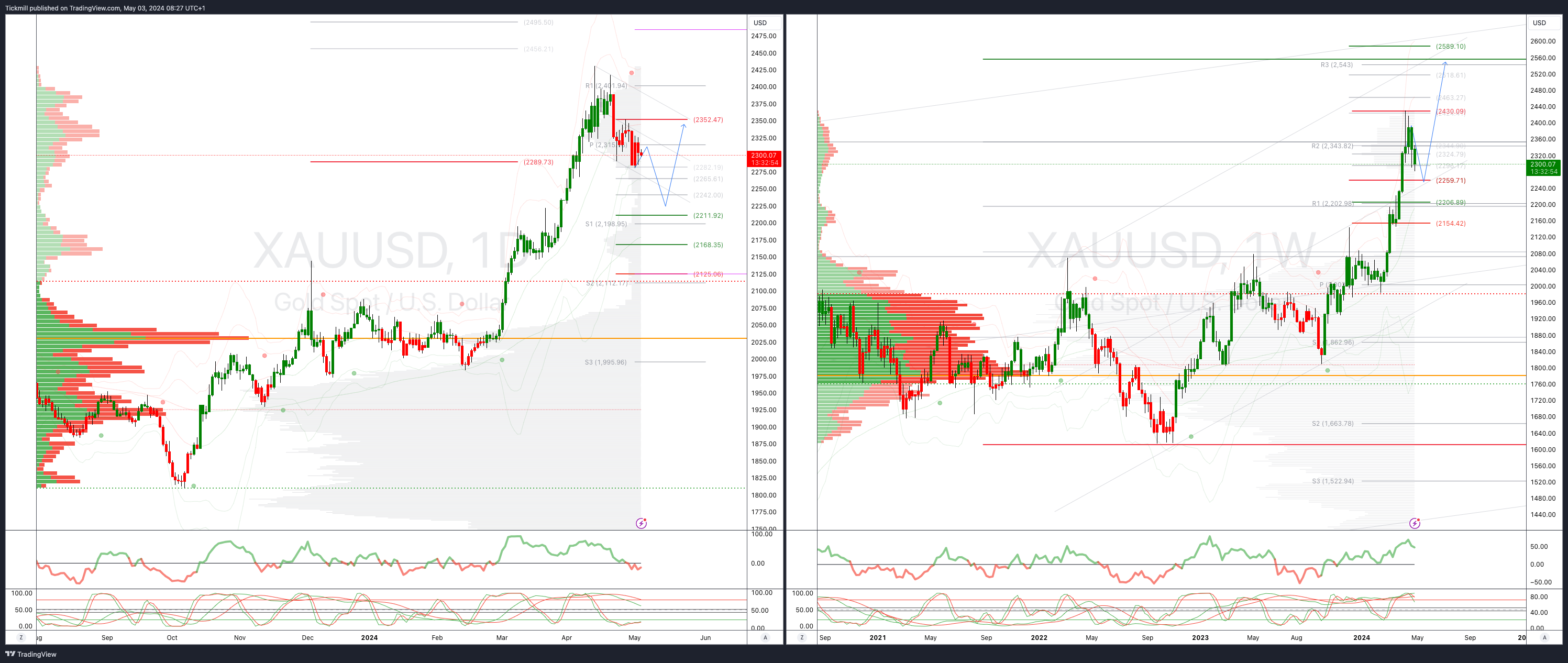

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bearish

Weekly VWAP bullish

Above 2360 opens 2400

Primary support 2260

Primary objective is 2560

BTCUSD Bullish Above Bearish below 63000

Daily VWAP bearish

Weekly VWAP bullish

Below 57500 opens 55900

Primary resistance is 63000

Primary objective is 53877

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!