Dissecting the Markets: Dovish NFP Report Shifts Fed Expectations, Boosts EUR/USD

The US Non-Farm Payrolls report for October delivered a stark downside surprise, with the economy adding only 12K jobs compared to consensus estimates of 113K. This figure also reflects a sharp decline from the downwardly revised September figure of 223K jobs, previously reported at 254K. The unemployment rate remained steady at 4.1%, aligning with market expectations.

The substantial miss in payroll additions has raised concerns about the underlying momentum in growth of the labor demand. While the unemployment rate remains low, the stagnation in job creation suggests potential headwinds for consumer spending.

Despite the weak headline employment number, wage growth showed resilience. Average hourly earnings increased by 4.0% year-over-year in October, in line with expectations. On a monthly basis, wages rose by 0.4%, exceeding both the forecast and the previous month's growth of 0.3%. Sustained wage growth suggests that inflation pressures may remain elevated for a longer time that expected earlier.

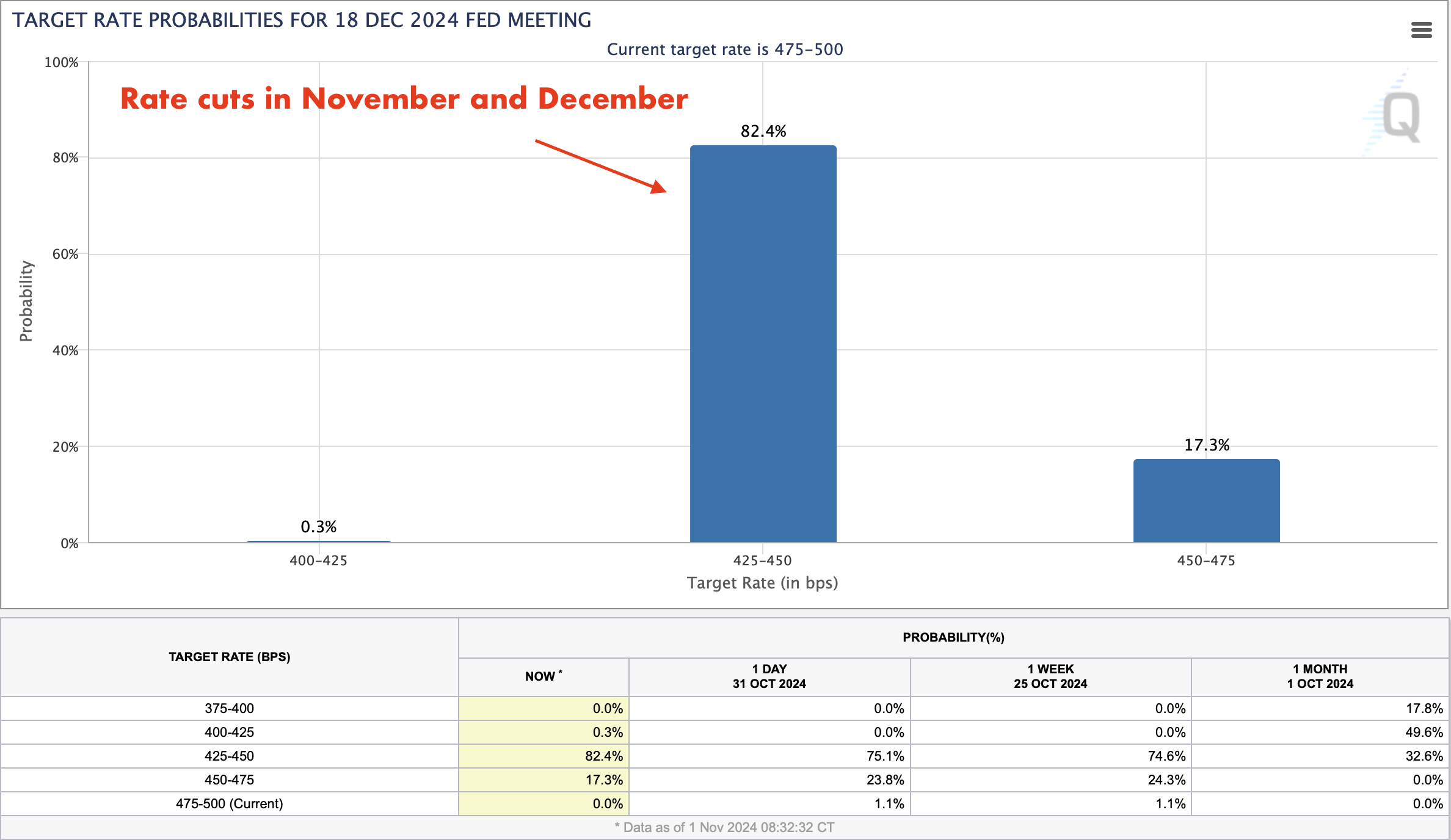

Nevertheless, the drop in hiring rates has had an immediate impact on monetary policy expectations. Fed funds futures are now pricing in a higher probability of consecutive 25 basis point rate cuts at the Federal Reserve's November and December meetings. The odds of a November cut surged from 75% to over 82% following the NFP release:

This dovish shift reflects growing concerns that the Fed may need to provide additional accommodation to support the economy. Lower interest rates typically reduce the yield advantage of the dollar, making it less attractive to foreign investors and exerting downward pressure on the currency.

In response to the NFP data, the EUR/USD pair rose, attempting to establish a foothold above the 1.0900 level. However, the move lacked immediate conviction, suggesting that market participants are awaiting US elections and FOMC meeting results to adjust expectations.

However, the euro's potential for a sustained rebound against the dollar has been improved by recent positive surprises in Eurozone economic data. Eurostat reported that the Eurozone economy expanded by 0.9% year-over-year in the third quarter, accelerating from 0.6% in the previous quarter. This growth was primarily driven by a surprisingly strong performance from the German economy, the bloc's largest.

Additionally, the preliminary inflation report indicated that the growth of consumer prices accelerated more than expected, reaching 2.0% in October from 1.7% in September. Rising inflation may prompt the ECB to reassess its monetary policy stance, potentially supporting the euro.

From the technical perspective, EURUSD rebound apparently gains traction as the mix of recent dovish US and hawkish EU data may be gradually tilting the scales against USD, at least in the near-term. Short-term target for the pair may reside near the horizontal resistance level at 1.10:

Later today, the market's attention will turn to the ISM Manufacturing PMI for October. The consensus forecast anticipates a slight uptick to 47.6 from September's 47.2. While still below the 50 threshold that separates expansion from contraction, an improvement could mitigate some concerns about the manufacturing sector's health.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.