Dollar On Watch As Traders Wait For US Inflation

USD Drops on PPI Decline

The US Dollar is on watch today as traders brace for the latest US CPI data. Yesterday, USD fell sharply as US PPI came in below forecasts. Core PPI was seen slipping to 0% from 0.3% prior while the headline reading fell to 0.1% from 0.2% prior. The data has been taken as an encouraging sign that overall inflation likely continued lower last month with the US Dollar falling accordingly.

CPI On Watch

Today, the market is looking for annualised CPI to remain unchanged at 3% YoY. If confirmed, the data will likely be broadly neutral for USD given that September easing expectations are already well baked into price. However, if see a downside surprise today, this should further bolster expectations of a quicker pace of easing from the Fed, driving USD lower near-term. On the other hand, if we see any upside surprise in today’s data this will likely dilute easing expectations beyond September, causing some lift in USD.

Bostic Says More Data Needed

Speaking yesterday, Fed’s Bostic said the bank needs to see more evidence of inflation returning to target before he can support a rate cut. However, he noted that recent data had made him more confident and if the economy continues to track its current trajectory, he expects rates to be lower by year end.

Technical Views

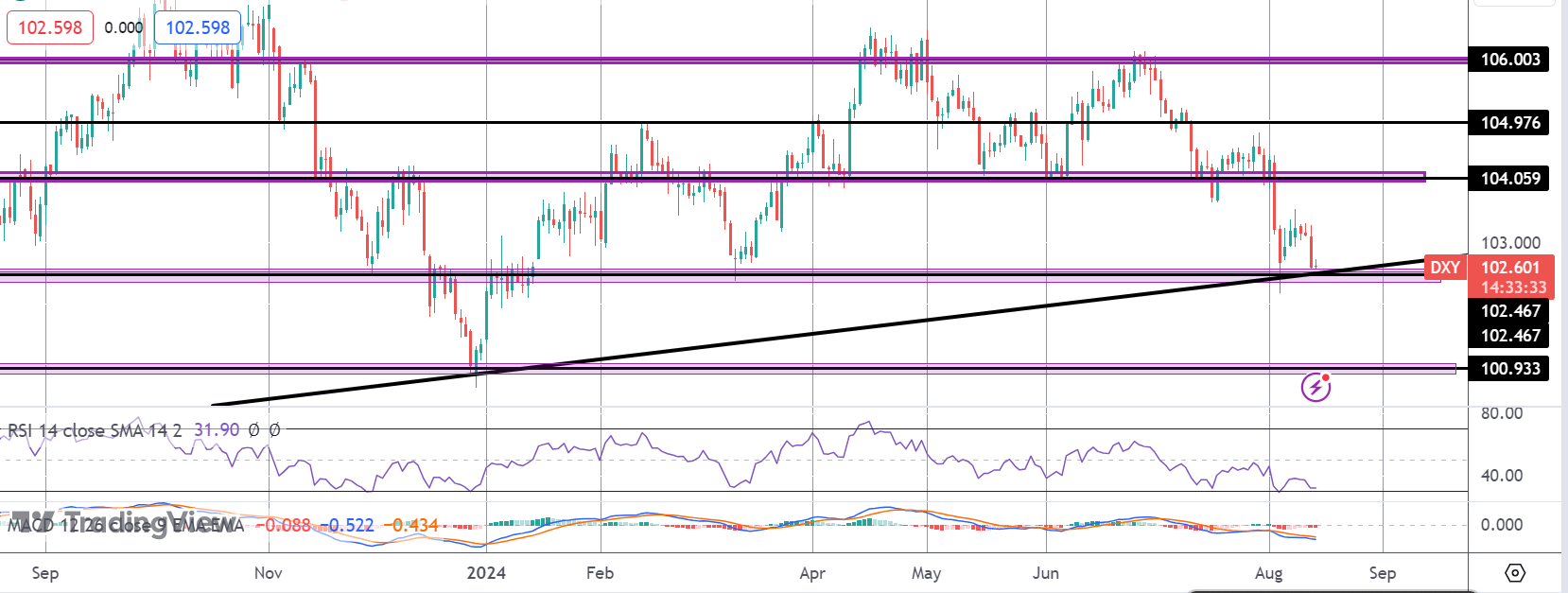

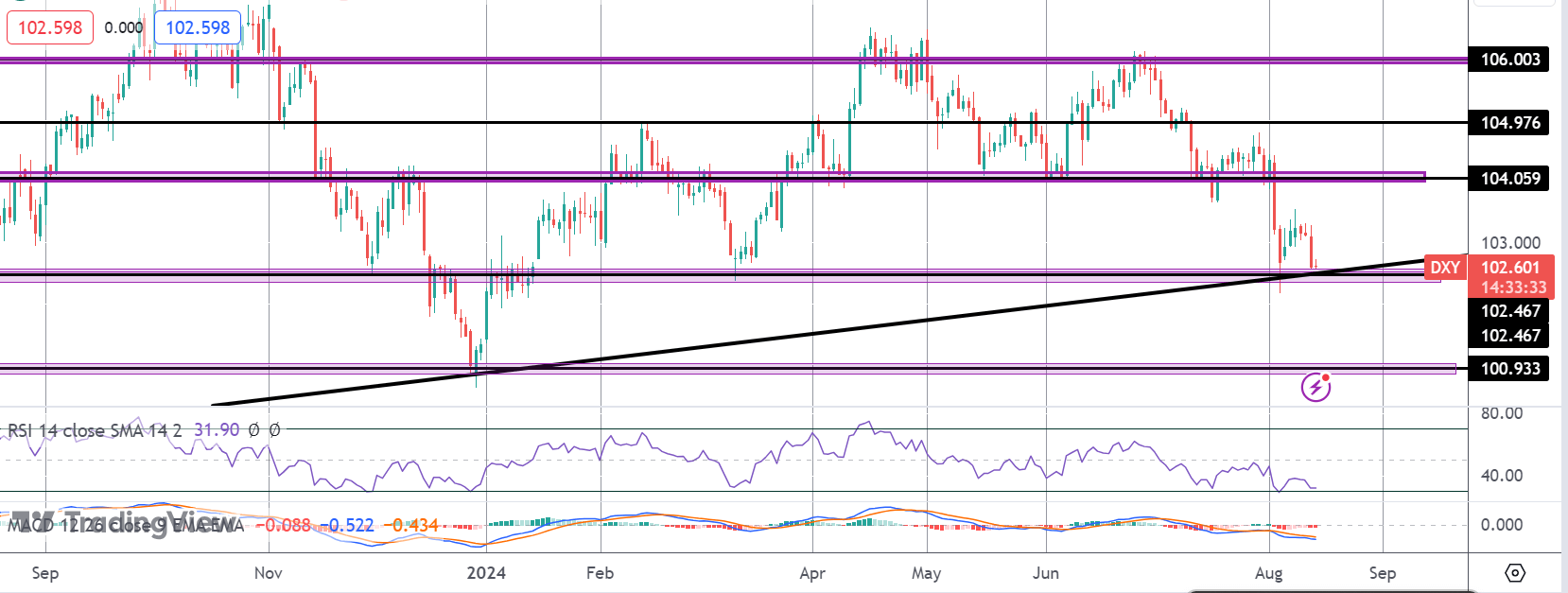

DXY

The index is once again testing support at the 102.46 level and the bull channel lows. With momentum studies bearish, risks of a deeper push towards 100.93 are seen if price breaks lower here. To the topside, 104.05 remains the key hurdle for bulls to get back above.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.