Follow The Flow: AUDCHF Trending Lower

CHF Stays Strong

The Swiss Franc has been the best performer again today over early European trading. The global equities rout we’re seeing on the back of the SVB collapse is driving a wave of safe-haven demand for the Franc. Additionally, the SNB retains one of the more hawkish outlooks among G10 central banks currently, which is also helping keep the currency supported. With traders pairing back their rate projections for the Fed and the ECB on the back of recent market turmoil, the Franc looks poised to gain further as it attracts greater capital inflow.

AUD Under Pressure

AUD has been among the weaker performers today. The risk aversion sweeping across markets has hit the high-beta currency hard and makes AUDCHF vulnerable to further losses near-term. With retail traders overwhelmingly long the pair, there is plenty of room for the current downtrend to extend further in the coming session. One potential catalyst is today’s US CPI data. If inflation is seen coming in above forecasts this will heighten global uncertainty, putting further pressure on stocks and risk currencies and driving greater safe-haven demand for the Franc.

Technical Views

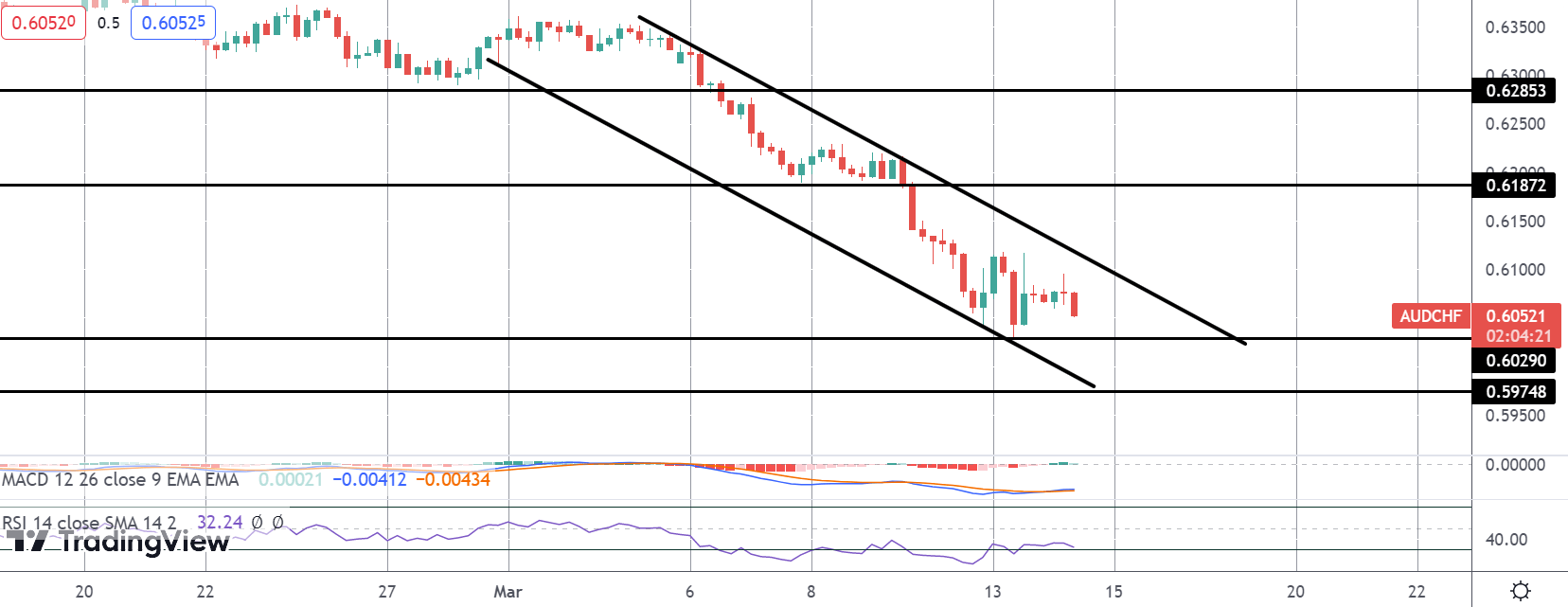

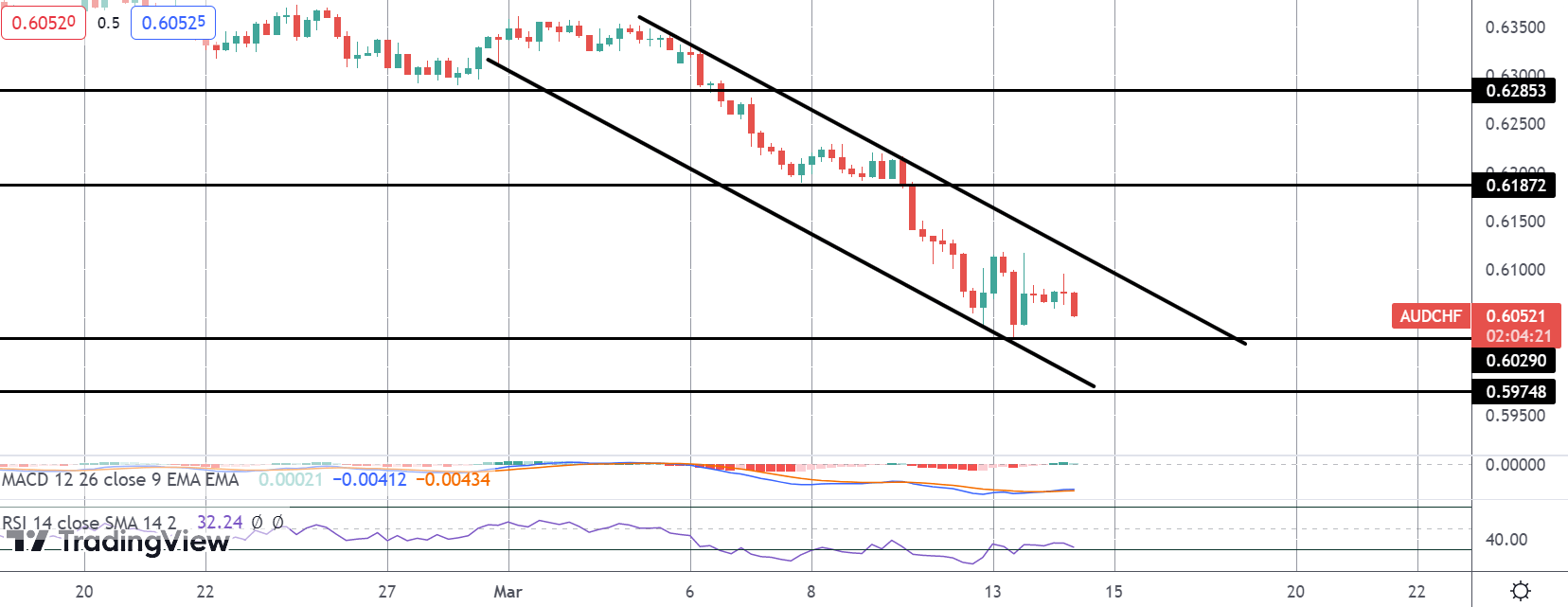

AUDCHF

The sell-off in AUDCHF has been framed by a well-defined bear channel. With price now turning lower again within the channel, the focus is on a break of the current .6029 lows targeting a move down to .5974 next. Momentum studies are flat for now though a break of current shows should encourage fresh momentum to drive the move further.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.