Institutional Insights: Goldman Sachs Trade Desk Views on Gold

.jpeg)

Goldman Sachs -Desk Thoughts:

- As anticipated, following Trump’s comments on August 12th, gold will not be subject to tariffs.

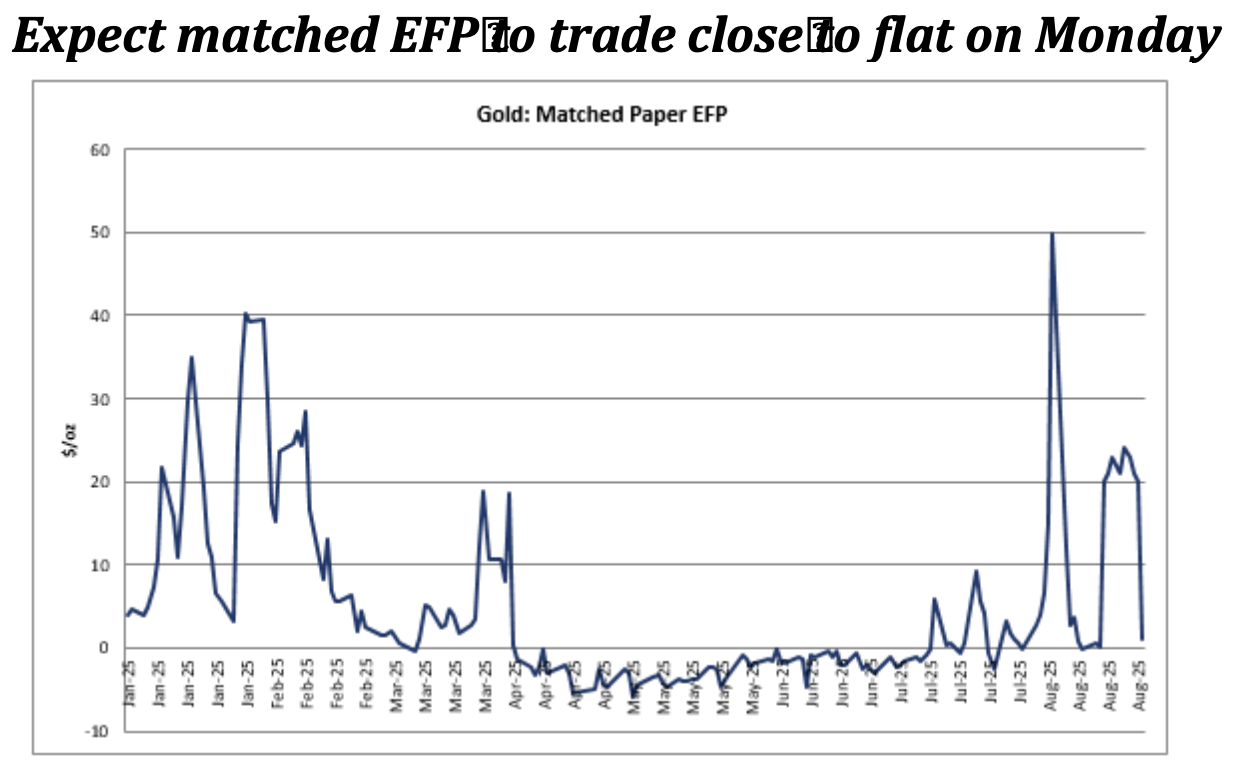

- The EFP strength to +$20/oz (December matched) likely stemmed from physical traders hesitating to take the opposing side of the macro bid (selling CMX/buying LBMA) due to the absence of formal tariff clarification. While the market expected clarification soon, the risk of losing ~$500/oz by shorting the EFP to gain $20/oz remains a tough decision, especially given the volatility after January's move.

- We anticipate December EFP to revert to $2-3/oz on Monday, which could temporarily pressure CMX. However, we do not believe the physical flows will be substantial enough to disrupt the broader CMX bid.

- Notably, the White House clarified that Central Bank flows, exempt from trade statistics, will remain unaffected.

Tony’s trading insights, paraphrased from the Weekend Macro Call, highlight several catalysts driving gold prices higher. The first major factor is the market's reaction to Trump’s renewed criticism of the Federal Reserve, sparking concerns about the Fed’s credibility and the potential implications for the dollar. When layering in a short dollar view, the natural question arises: what asset pairs should be on the long side of the cross? Recent issues, such as the UK budget and fiscal challenges in France, have cast doubt on whether other currency pairs that performed well in recent months remain attractive for deploying length against a dollar short. In such scenarios, investors often turn to gold, which has been the trend over the past week.

Regarding who’s buying, a diverse set of players within the franchise is engaging with gold. In Western markets, there’s noticeable re-engagement from real money investors, hedge funds, and institutions. Their challenge lies in navigating an asset that has rallied sharply to record highs without exposing themselves to significant risks during a positioning flush. Consequently, many are opting for levered upside structures, incorporating light exotic knock-outs or digitals to gain upside convexity. While these strategies require some premium spending, overall delta-adjusted allocations remain relatively modest. Notably, clients with pre-existing structures saw those trades knocked out during the breakout and had to re-initiate positions.

The rapid rally and volatility in basis markets present additional challenges. Support levels are being discussed, with $3,500 in spot frequently mentioned, though this is now several standard deviations below the current price. Longer-term support seems closer to $3,450, which is considerably lower. Investors looking to add to their trades at these levels must find ways to stay engaged, often through options or light exotic structures. From Tony’s perspective, 2-3 month upside strategies funded by shorts and puts remain appealing. Despite a slight uptick in volatility, risk reversals are still priced in the mid-teens, with a one-and-a-half to two vol premium over the call. While this premium exists, Tony argues it’s still undervalued relative to the potential price trajectory ahead.

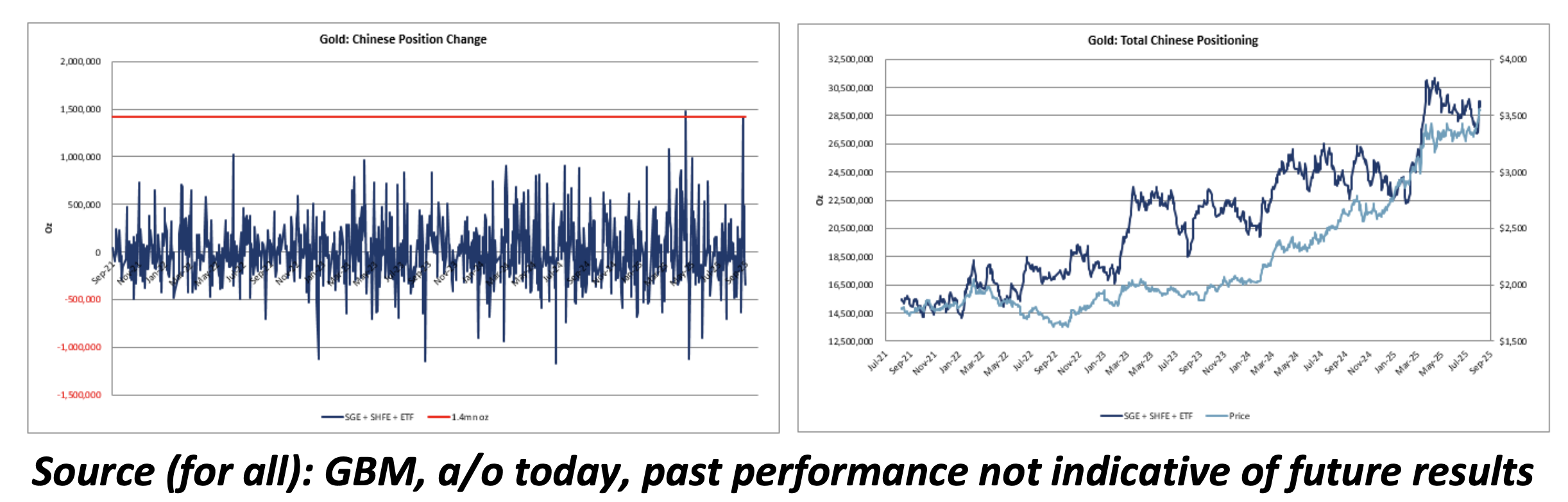

Franchise Flows: This week marked notable re-engagement from both Chinese and Western traders. In China, positioning shifts across SHFE, SGE, and ETFs reached 1.4 million ounces on Monday, representing the second-largest change in five years (the highest being April 22nd, when gold reached its previous all-time high). Chinese trading volume on Monday was 1.57x CMX compared to the YTD average of 0.65x, suggesting that renewed activity from Chinese speculators is disproportionately influencing CMX prices.

Western investor interest has been widespread, driven by topside macro buying (pod + CIO) alongside asset manager and real money involvement. Desk option volumes hit a YTD high this week, reflecting a reaction to Q1’s challenging moves following Q4 2024 profit-taking. Macro flows have centered around leveraged structures (e.g., RKOs, digi RKOs), contributing to the risk-reversal stagnation. A concern remains that persistent surface selling could force hedge funds to exit their positions if prices make a sharp 5% upward move—similar to the scenario in April.

Our desk remains positioned with long convexity in the 2-3 month tenor bucket via risk reversals while maintaining short positions in 1x4 structures. Predicting price direction is challenging given the recent chart breakout, but our portfolio is designed to capitalize on a potential 10% price surge from $3,550/oz.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!