Lack of Dovish Surprise in NFP is Good News for the Dollar

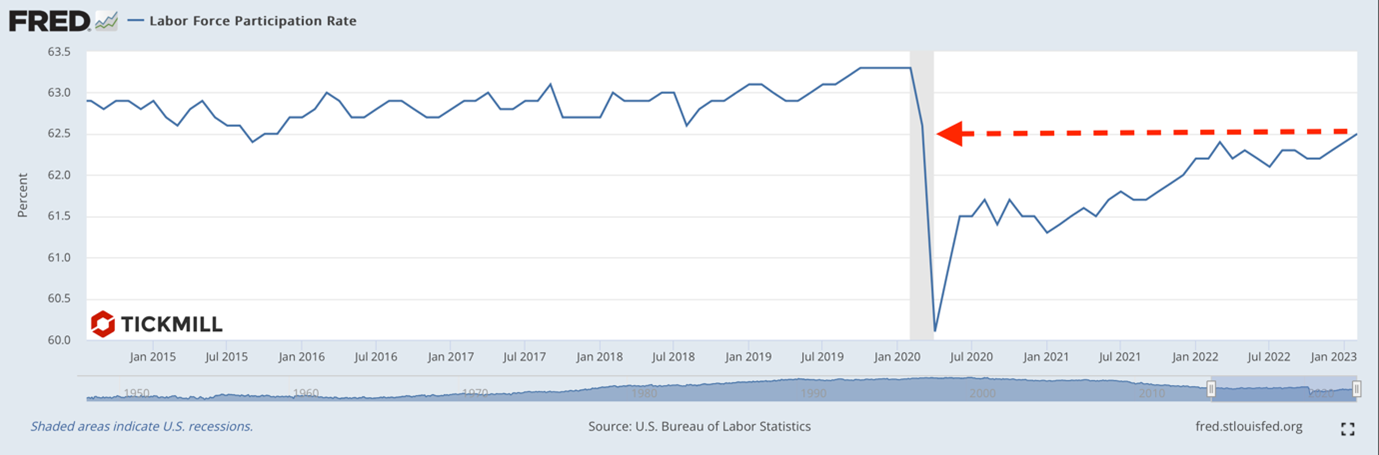

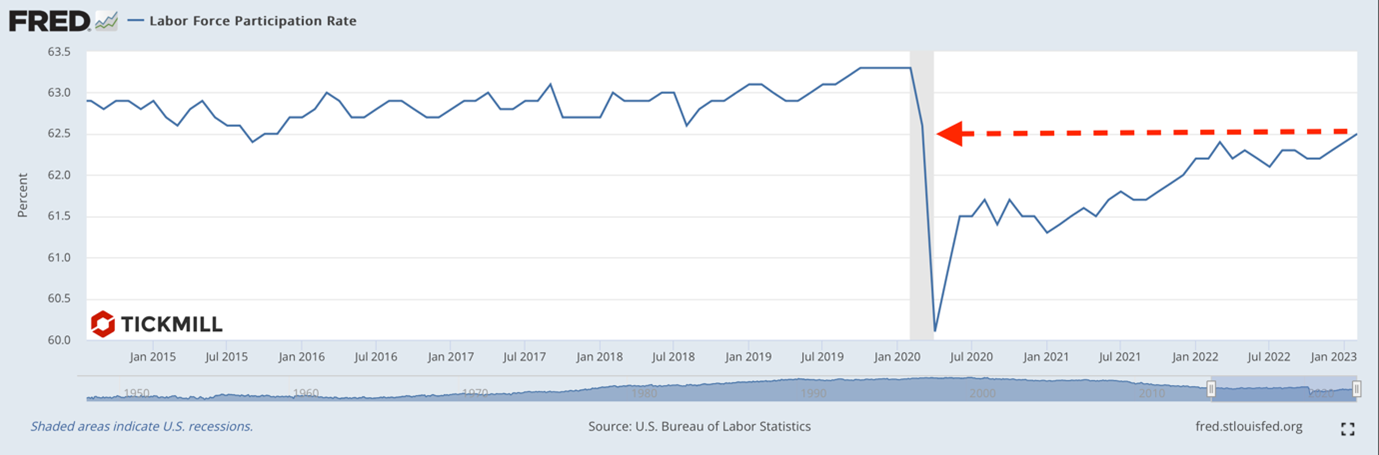

Due to Good Friday, the currency markets are seeing some minor changes with low trading volumes and reduced liquidity. The Non-Farm Payrolls report briefly shook up prices, but it mostly met market expectations with job growth at 236K (forecasted 239K) and a 0.3% increase in wages, as anticipated. However, unemployment dropped to 3.5%, and the labour force participation rate increased by 0.1% to 62.6%. Despite the growth, this indicator still hasn't returned to pre-pandemic levels:

Earlier data on the labour market this week, such as JOLTS data, ADP, and hiring components in ISM activity indices, showed that the labour market is gradually losing its role as the sole powerful driver of inflation. Thursday’s report on initial jobless claims showed a rise to 228K, while long-term claims jumped to 1.823 million, well above the forecast of 1.699 million. Initial jobless claims have been on an upward trend since mid-February, which corresponds to JOLTS data indicating a sharp decline in job openings in February, from 10.5 to 9.9 million:

This suggests that firms are either cutting back on hiring or the influx of labour supply is reducing the number of job openings. Given the other labour market data, it seems that the primary contribution to this trend is a weakening demand for labour.

Nevertheless, the lack of a significant bearish surprise in the NFP report is already positive news for the market after a series of weak indicators earlier this week. The neutral report will most likely strengthen the market's expectations that the Fed will make one more 25 bps rate hike before announcing a pause. This is necessary since inflation is still significantly higher than the target level of 2%. For the dollar, this is a moderately positive scenario, and the US currency index will likely find solid support around 101.50 and rebound to reach the target of 102.50 next week:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.