More than simply a trade truce

The signs of softening stance of the White House in talks with China before the two leaders met at the G-20 summit (Trump’s phone call to Xi, reports about “extended ” meeting), to the general surprise, were not empty speculations, but a forerunner to extending the truce. The results of the meeting between Trump and Xi set a new vector of cooperation between the two states, as Trump accepted some Chinese demands, such as extending pause in tariff escalation and easing of pressure on Huawei. Markets welcomed this decision by increasing the demand for risky assets, the dollar strengthened, the yield on 10-year notes rose, and SPX futures began trading with a positive gap at around 2975 points.

And if the tariff truce was within the range of expected scenarios, then the removal of some restrictions on Huawei prompted China to return to the negotiating table, which considered attacks on the Chinese telecom giant as forcing to negotiate with a “gun pointed to its head”. China, in exchange for easing sanctions on Huawei agreed to increase purchases of agricultural products in unspecified amount. Its manufacturers in the United States suffer huge losses, hit by the millstones of the tariff war.

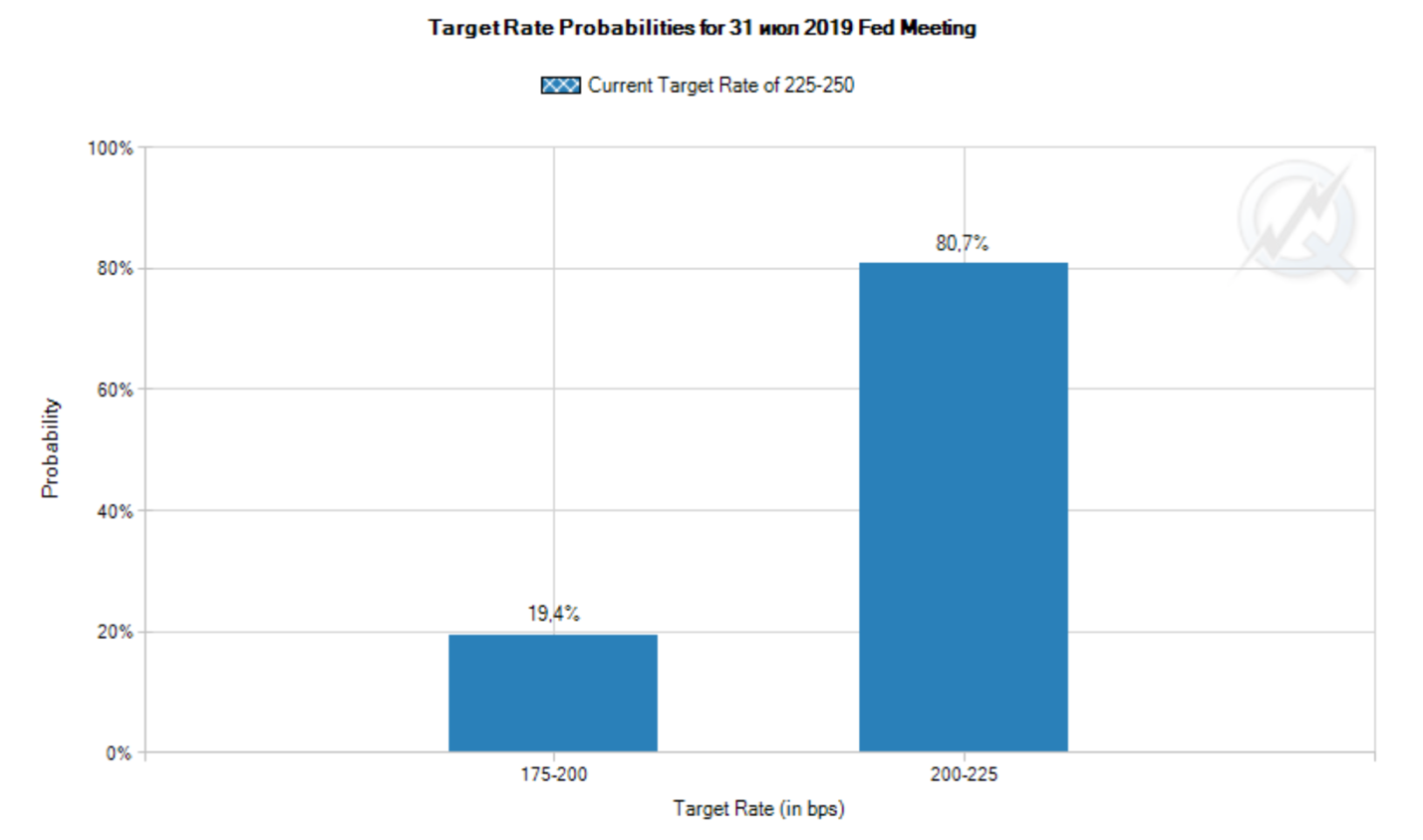

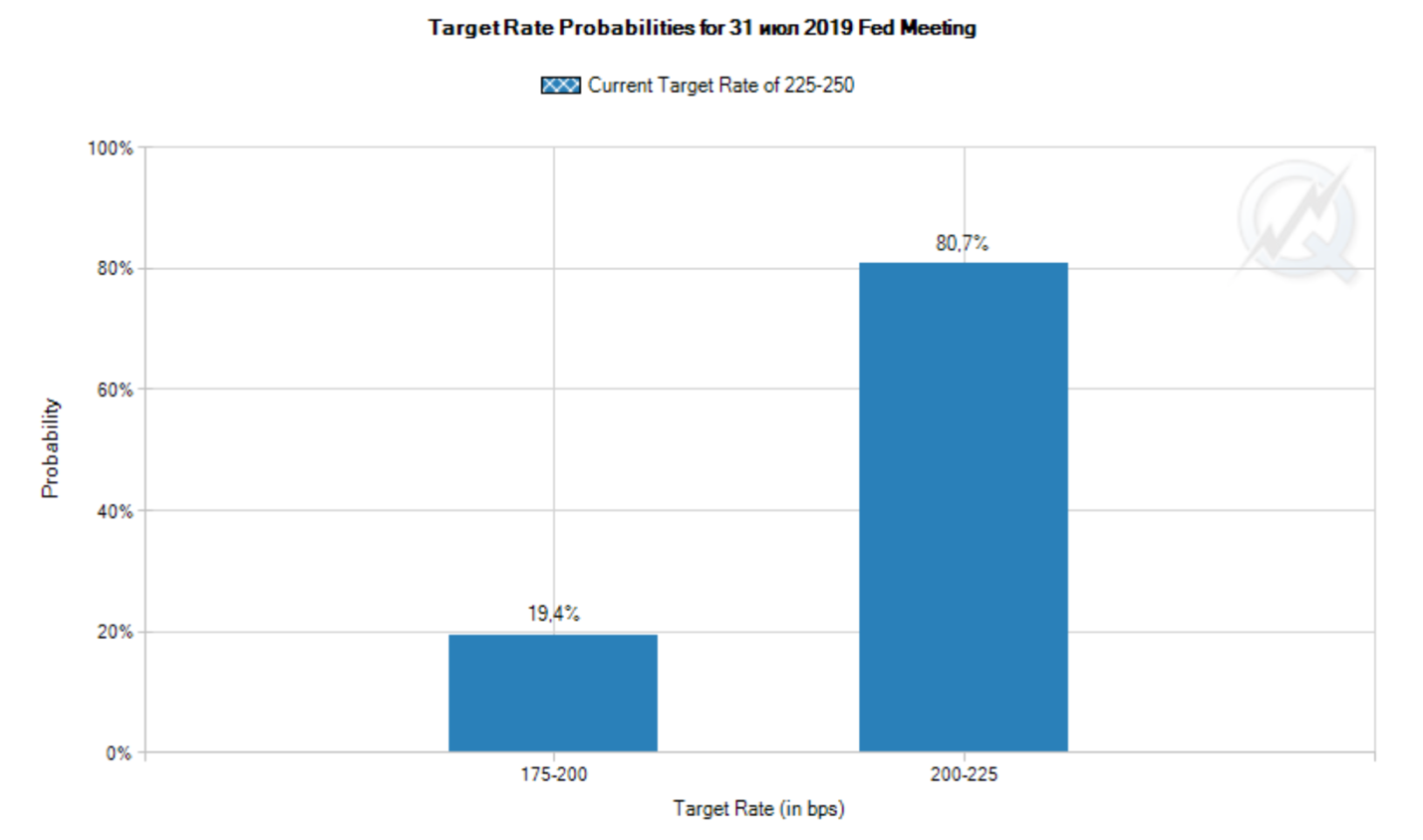

The chance of a rate cut by 50 bp in July keeps declining, according to futures trading with interest rate as an underlying asset, but the market remains confident that the Fed will lower the rate in July by at least 25 bp.

Asian stock markets got the biggest relief from the Trump-Xi decision. The Japanese Nikkei jumped by 2.1%, the Chinese CSI 300 by 2.6%, as the pause in the exchange of tariffs will allow firms to expand the horizon of production planning, which should add confidence to Chinese firms in decisions to boost hiring and capital investments.

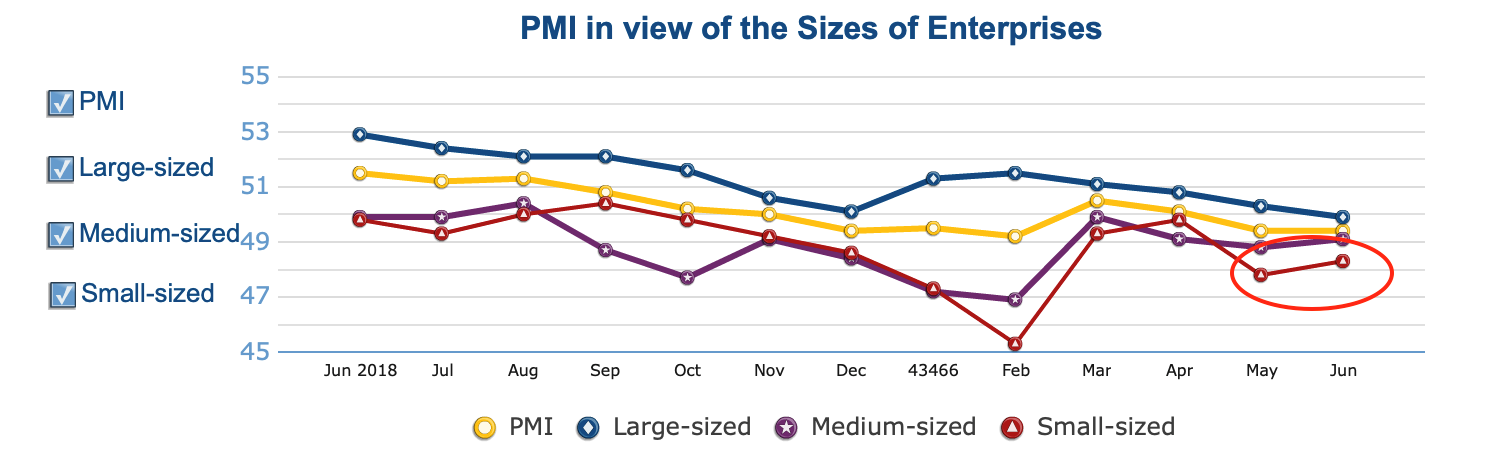

The official index of manufacturing activity in China fell to 49.4 points in June, remaining in the contraction territory for the third month, the data showed on Monday. The activity index of China’s factories, calculated by Caixin, dropped to 49.4 points, the worst since January of this year. Manufacturing PMI includes several sub-indices, such as output, new orders, input and output prices, delivery time of raw materials by suppliers, inventories, employment, etc. Despite the decline in the component of new orders (from 49.8 to 49.6 points), and hiring (from 47.0 to 46.9 points) the positive part of the report was a rebound in activity of small enterprises from 47.8 to 48.3 points:

Recall that small enterprises in China endured greatest pain from the tariff war since the combination of slowdown in growth and credit crunch led to credit tightening especially to this type of firms. Banks are willing to lend to large enterprises, seeking to maintain “healthy” assets on the balance sheet because of increasing probability of default by corporate borrowers. By this, they effectively block the channel of cheap liquidity opened by the Central Bank, intended for small firms.

It is not known whether the Chinese authorities will keep pause before new stimulus measures (favoured by the outcome of the Osaka meeting), but with the deterioration of the manufacturing sector, the likelihood of expanding support measures is increasing, which should support risk appetite not only in the Chinese stock market, but also abroad in the form of lower demand for “safe havens”.

European data increased pressure on the euro. Activity indices in production in Italy, France and Germany continued to fall. Unemployment in Germany fell by 1K, the unemployment rate in the Eurozone fell more strongly than expectations to 7.5%. EURUSD is heading to 1.13 level, losing almost half of percent today.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.