The FTSE Finish Line: June 25 - 2025

The FTSE Finish Line: June 25 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London's primary stock indices remained largely unchanged to modestly lower heading into the close on Wednesday as investors assessed a series of corporate earnings while also monitoring the fragile ceasefire between Israel and Iran. Global markets experienced a surge earlier in the week following a ceasefire between Iran and Israel, which ended a 12-day air conflict between the two rivals. Nonetheless, caution prevailed, and Washington described the ongoing discussions with Tehran regarding a long-term peace agreement as "promising." Investors were now turning their attention to a new wave of corporate earnings reports. The blue-chip index saw a 13.3% increase led by the defence engineering firm Babcock, which raised its medium-term forecasts, anticipating benefits from increased defence spending. Labour market statistics indicated weakening conditions, as wage growth trailed behind inflation and job vacancies declined – factors crucial for policy making. On Tuesday, Bank of England Governor Andrew Bailey highlighted evidence of a more subdued labour market and stated that interest rates were expected to continue decreasing.

Political concerns regarding Labour Prime Minister Keir Starmer and the value of the pound may arise if rebellious lawmakers from his party succeed in obstructing his proposed reforms to Britain's welfare system. Despite facing opposition from over 100 of his MPs, Starmer has pledged to continue with the reforms. A House of Commons vote, tentatively set for July 1, could potentially undermine the government's welfare agenda, representing a significant setback for Starmer, a year after Labour secured a considerable majority in the general election. This situation could also raise questions about Starmer's future as Labour leader, with the next general election anticipated in 2029.

Single Stock Stories & Broker Updates:

Liontrust Asset Management shares fell 3.8% to 396p, making it one of the top losers on the FTSE small-cap index, which rose 0.2%. The company reported a 28.2% year-over-year drop in adjusted profit before tax to £48.3 million ($65.82 million). They anticipate more challenging market conditions for returns in the coming years and introduced a new Capital Allocation Policy, which includes a minimum 50% payout ratio for dividends and plans for share buybacks. The stock is down 16.9% year-to-date.

Babcock shares rise 13.2% to 1,169p, the highest since November 2014, becoming the top gainer on the FTSE 100. The firm upgrades its medium-term operating margin outlook to at least 9% from 8% and anticipates mid-single digit revenue growth. It announces a £200 million share buyback and projects an annual underlying operating margin of 8%, up from 7.5%. JP Morgan increases its FY26-29 estimates by 3%-5% annually. Year-to-date, Babcock's stock has more than doubled, increasing approximately 123%.

Halford's shares rose 3% to 176.8p, with FY25 underlying pre-tax profit of £38.4 million surpassing expectations. Analysts from Peel Hunt noted profit progress amid cost challenges. The company forecasts FY26 pre-tax profit growth to be stronger in H2 due to economic uncertainties. CEO Henry Birch highlighted concerns regarding employment and geopolitical instability. Strategies to counter FY26 cost headwinds include pricing adjustments and exiting smaller sites. Year-to-date, the stock has increased by 33.3%.

WPP shares fell 1.2% to 515.80p as Barclays downgraded the stock to "underweight" with a price target cut to 550p from 700p. Barclays noted that media stocks with new management typically underperform by 10% until new strategies are announced, leading to uncertainty. WPP CEO Mark Read is stepping down after seven years. Analysts give an average "hold" rating with a median price target of 600p. The stock is down ~37.62% YTD.

Technical & Trade View

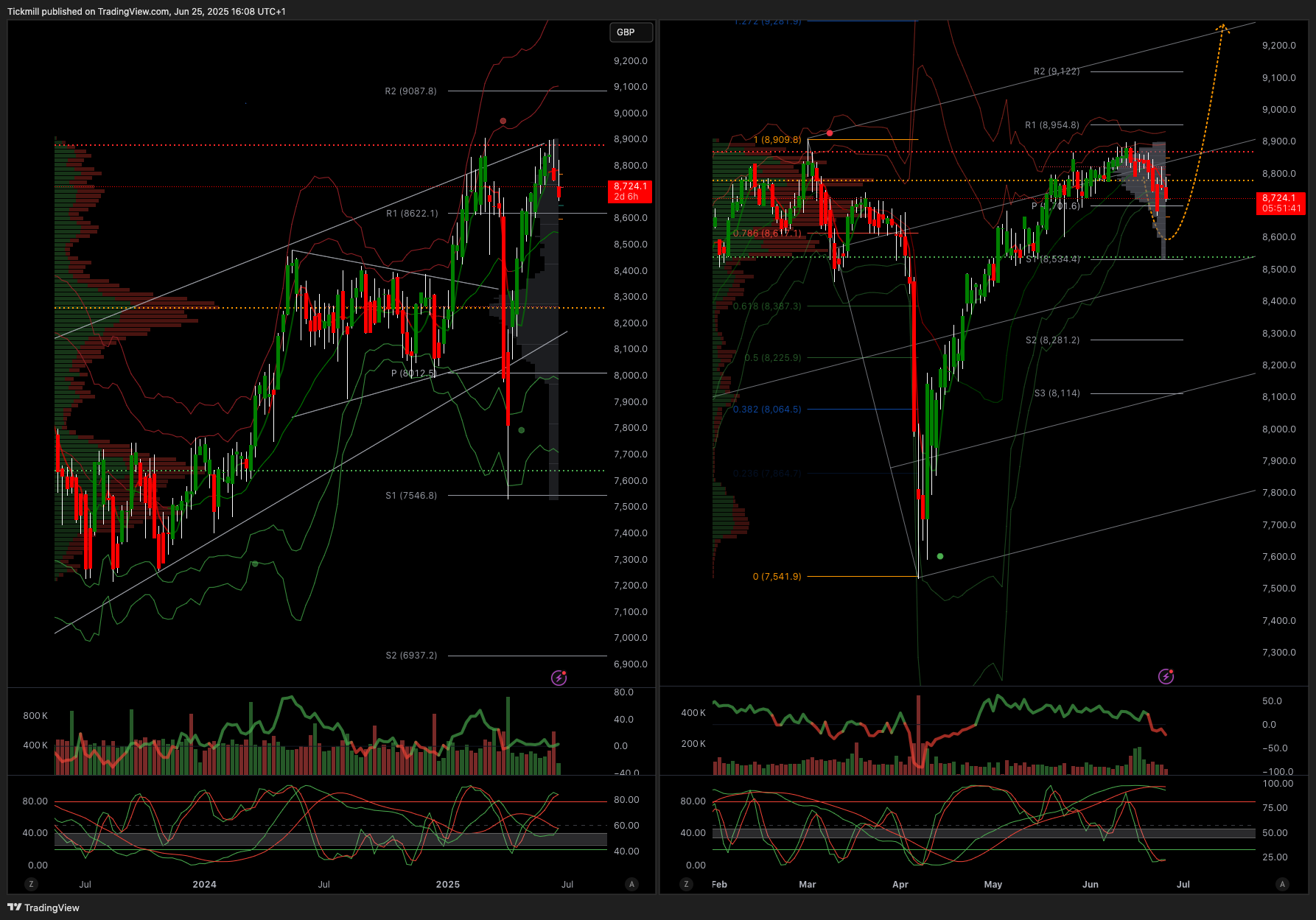

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!