Unusual Yen Price Moves Seen After BOJ

JPY Volatility

Traders are questioning whether we’re seeing the first signs of intervention today by Japanese authorities after USDJPY suddenly plunged around 1.2% before reversing the losses immediately. Overnight, the BOJ held policy unchanged, defying those expecting a policy response on the back of recent JPY deterioration. The bank reaffirmed its message that it does not target FX rates directly with monetary policy but will continue to monitor markets. Governor Ueda warned that rapid JPY depreciation is not desirable and the bank will intervene if necessary but so far, sees no need to.

Flash Crash

USDJPY has rallied another 7% off the April lows, taking the pair up to levels not seen since the 1990s. With price now trading above levels which saw Japanese officials intervening last year, traders are questioning at which point we are likely to see action. No official comment has been received on the price action we’ve seen today and it’s not clear whether this was simply linked to algorithmic trading errors ( so called ‘flash crashes’) or something else.

Level to Watch

Bloomberg is running an interesting piece today saying that an analysis of comments from Masato Kanda, the top currency official at the Japan MOF, 157.60 is the level to watch for intervention. With price now fast approaching that level, intervention risks are certainly ballooning. However, speculators are simply betting that without firm action from both the BOJ and government in unison, any reaction will prove short-lived.

Technical Views

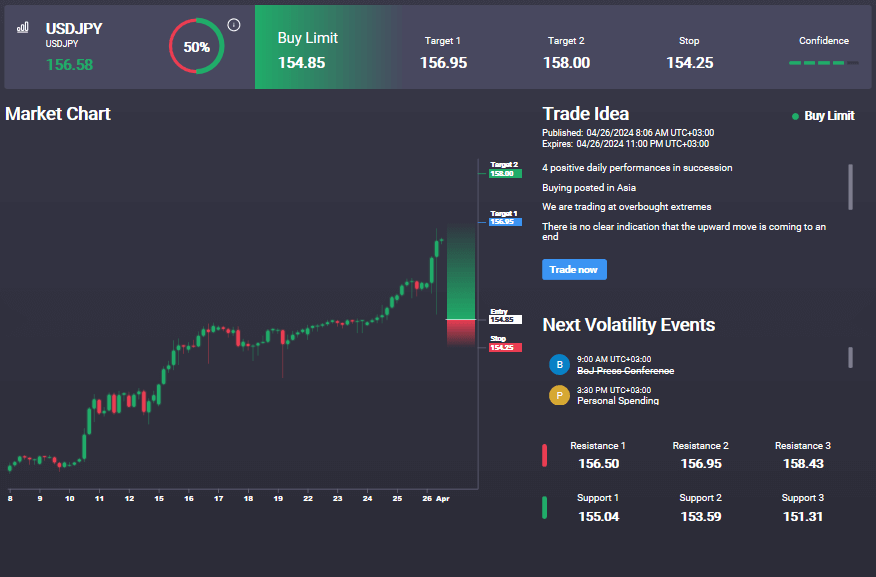

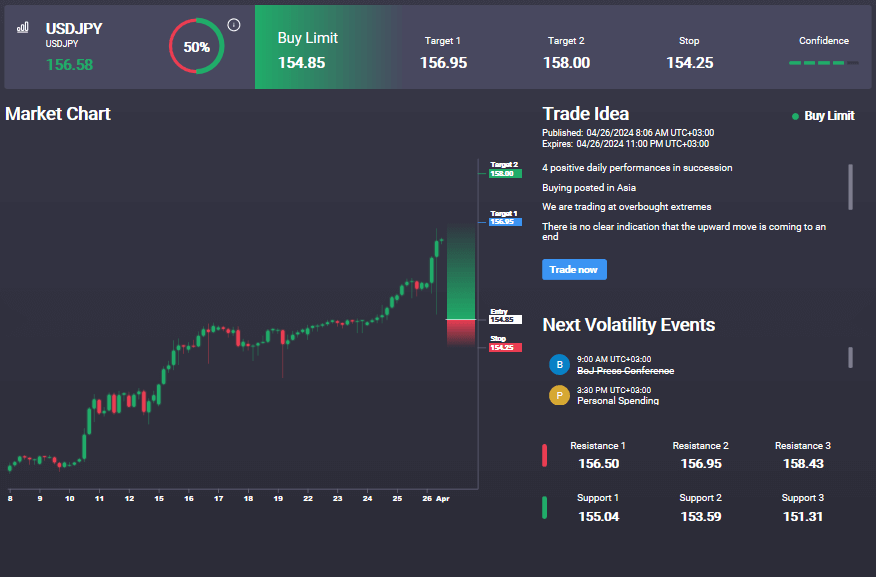

USDJPY

The rally in USDJPY has now taken the pair firmly above the 151.81 level with price now pushing up towards a test of the bull channel highs, stalling around the 156.42 level currently. Momentum studies remain bullish here, keeping focus on a continuation higher towards 158.28 next. Back below 154.89, 151.81 remains key support. Notably, we have a bullish signal in the Signal Centre today set below market at154.85 suggesting a preference to buy and dips and stay long.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.